how to pay indiana state taxes quarterly

Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and You expect to owe more than 1000 when you file your. How to Pay Indiana State Taxes.

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

If you expect to have income during the tax year that.

. I determine my total tax bill federal and state based on last year and divide that by 12. Go to EFT Registration in the INtax menu on the left side of the screen. Claim a gambling loss on my Indiana return.

Credit or debit cards. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40. Know when I will receive my tax refund.

File online using IN Tax. To make an estimated tax payment online log on to wwwingovdor4340htm. You can also pay online by authorizing a.

As described below Social Security is exempt from the 323 flat state income tax in Indiana while other forms of retirement income are not. One to the IRS and one to your state. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check.

Indiana has reciprocal agreements with some states including Wisconsin and Kentucky which allow people living in Indiana and working in these states to pay income tax to only Indiana. Take the renters deduction. You may pay estimated taxes either online by phone or through the mail.

Pay your taxes by debit or credit card online by phone or with a mobile device. Visit IRSgovpaywithcash for instructions. Payment is due by January 31 of the following year.

Do this even if you have a single-member LLC set up - only corporate taxes need to be filed through the IRS Electronic Federal Tax Payment System EFTPS and this is a bit harder to set up. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Pay directly from a checking or savings account for free. Line I This is your estimated tax installment payment. This means you may need to make two estimated tax payments each quarter.

Complete and submit the online registration form. The state income tax rate is 323 and the sales tax rate. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

Some states also require estimated quarterly taxes. You can pay all of your estimated tax by April 15 2021 or in four equal amounts by the dates shown below. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. Payment for Unpaid Income Tax. INtax only remains available to file and pay the following tax obligations until July 8 2022.

The states average effective property tax rate is 081 which is low on a national scale while the state sales tax rate is quite high at 7. Claim a gambling loss on my Indiana return. You can make a cash payment at a participating retail partner.

You can pay with credit cards online or over the telephone. I know that I will need to pay my federal taxes quarterly and my state taxes annually. Small Business Payment Type options include.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. File online using IN Tax.

Form UC-1 Quarterly Contribution Report is due the last day of the month following the end of the quarter April 30 July 31 October 31 and January 31 for unemployment taxes. Estimated payments may also be made online through Indianas INTIME website. We then calculated how much this person would pay in.

If you are filing as a sole proprietor a partner an S corporation shareholder andor a self-employed individual and expect to owe taxes of 1000 or more when you file a return you should use Form 1040-ES Estimated Tax for Individuals to calculate and pay your estimated tax. However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. Each month the requisite amount is transferred into a high-yield savings account.

Take the renters deduction. Individual Payment Type options include. Form WH-3 Annual Withholding Tax return is to be filed each year by February 28.

This is not an automatic withdrawal. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Pay my tax bill in installments.

Have more time to file my taxes and I think I will owe the Department. Decide on your method of payment. But were you aware that individual estimated payments may be submitted using INTIME DORs online e-services portal.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you did make estimated tax payments either they were not paid on time or you did not pay.

Have more time to file my taxes and I think I will owe the Department. Find Indiana tax forms. Pay my tax bill in installments.

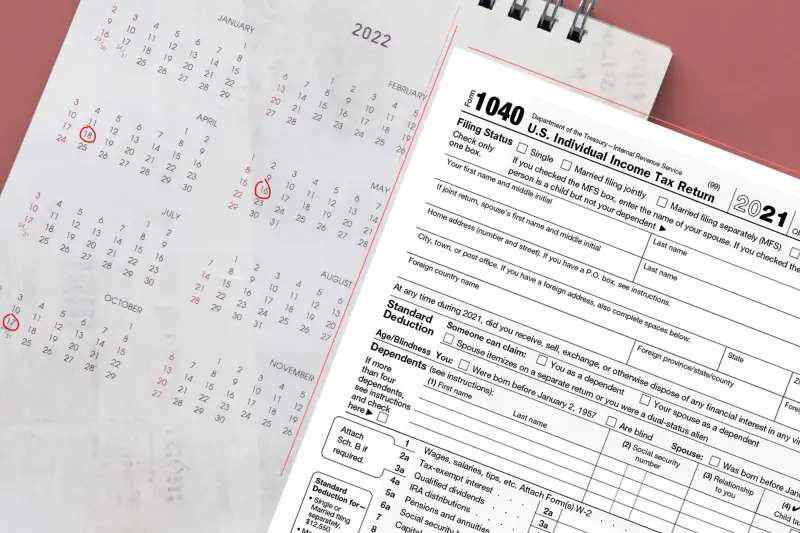

You can find your amount due and pay online using the intimedoringov electronic payment system. The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022. Complete the contribution report that.

Make an Individual or Small Business Income Payment. On the first screen select Estimated Tax as the reason for payment 1040ES as the Apply field and the year you are making the payment for. The state income tax.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales.

Although the registration form status states it is pending your bank information is stored and you may make an ACH debit payment immediately. Know when I will receive my tax refund. The tax bill is a penalty for not making proper estimated tax payments.

In order to ease my cash flow when paying taxes I break it down by the month. Find Indiana tax forms. QuickBooks Self-Employed calculates federal estimated quarterly taxes.

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago

Indiana County Income Taxes Accupay Tax And Payroll Services

Pennsylvania Property Tax H R Block

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Quarterly Tax Calculator Calculate Estimated Taxes

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Helpful Sales Tax Steps For Amazon Fba Sellers Sales Tax Amazon Fba Business Tax Return

Reciprocal Agreements By State What Is Tax Reciprocity

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

How Do I Know If I Need To Pay Quarterly Taxes Delta Wealth Advisors

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Indiana Sales Tax Small Business Guide Truic

Cryptocurrency Taxes What To Know For 2021 Money